capital gains tax philippines

Titles are defined as shares bonds debentures founders shares and other titles of companies or other legal persons incorporated in Cyprus or abroad and options thereon. While the Capital Gain Tax is imposed on the gains presumed to have been realized by the seller from the sale exchange or other disposition of capital assets located in the Philippines including other forms of conditional sale the Documentary Stamp Tax is imposed on documents instruments loan agreements and papers evidencing the.

According to the Philippine Tax Code Capital Gains Tax is a tax that is imposed on earnings that the seller has gained from the sale of capital assets.

. In contrast the Federal Government will differentiate between long-term capital gains and short-term capital gains for tax purposes. Long-term capital gains tax is a tax applied to assets held for more than a year. For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0.

Capital Gains Tax is charged at a flat tax rate of 6 of the gross selling price and must be. Conformity between book and tax reporting is not required. Income tax holiday ITH for four 4 to seven 7 years depending on the combination of both location and industry priorities as determined in the SIPP ITH shall be followed by.

Under the Tax Cuts Jobs Act which took effect in. Profits from disposals of corporate titles are unconditionally exempt from CIT. Capital gains tax rates range from zero percent up to 37.

A 10-year 5 Special Corporate Income Tax SCIT on gross income in lieu of all national and local taxes or enhanced deductions ED at the. Capital gains derived by foreign corporations from the sale of shares of stock not traded on the Philippine stock exchange are subject to a flat tax rate of 15 previously 5 on the first US2000 and 10 in excess thereof. The long-term capital gains tax rates are 0 percent.

What S Your Tax Rate For Crypto Capital Gains

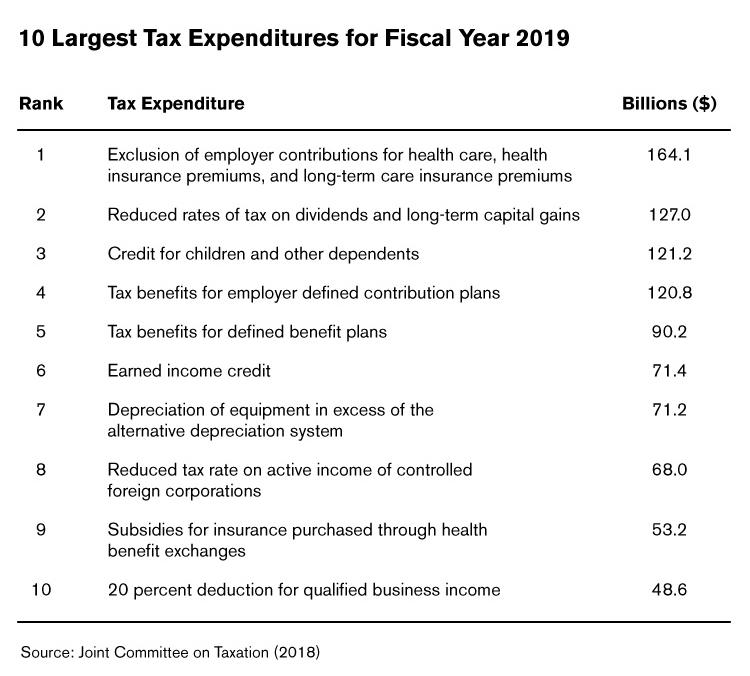

What Are Tax Expenditures And Loopholes

How To Transfer Land Titles In The Philippines And What Are The Documents Needed Title Transfer Philippines

The War On Inequality Is Coming To The Stock Market Three Ways How To Trade It Stock Options Trading Stock Market Financial Markets

Pin By Krystal Pino On Chicago Real Estate Attorney What Is Capital Capital Gains Tax Tax Lawyer

Blue Chip Stocks Philippines With High Dividends 2018 Finance Gma Network Stock Market

Classifieds Database Foreclosurephilippines Com Real Estate Investing Foreclosed Properties Buying A Condo

The Market Risk Premium Is The Additional Return An Investor Expects From Holding A Risky Market Portfolio Inst Market Risk Business Valuation Safe Investments

Car Insurance Tax Deductible Malaysia 2021 Tax Deductions Car Insurance Getting Car Insurance

Property Report March 2014 Condominium Culture In Myanmar Will Capital Gains Tax Impact The London Market Bri London Market Property Property Report

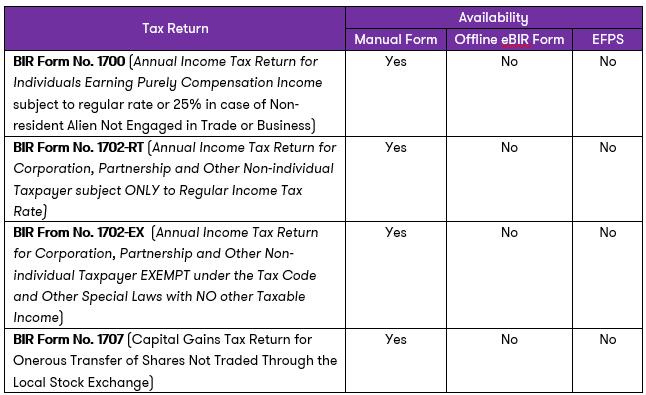

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Tax Efficient Investing In Gold

All About Capital Gains Tax How To Calculate Income From Capital Gains Indexation Concept Youtube

Pin By Jacob Bejec On Jake Legal Forms Template Free Templates

How To Calculate Capital Gains Tax H R Block

Brrrr Investing Buy Rehab Rent Refinance Repeat Investing Investing Strategy Real Estate